1031 Exchange Financing in California

While real estate investing can be a gratifying and lucrative undertaking, it is also vexing when capital gains taxes cut into the profits. Yet making a 1031 Exchange allows property owners to convey their holding while deferring such payments. If the owner sells the property while acquiring a similar piece of real estate, the levy on these profits can be suspended far into the future.

If time to buy a comparable building is growing short, a bridge loan can serve to preserve the connection between the two transactions. 1031 Exchanges are also known as like-kind exchanges. This is because the assets must correspond closely to each other.

Hard Money Loan Request

If you prefer to email us, fill out the form below and an associate will contact you to review the loan scenario and provide a quote.

The 1031 Exchange Defined

Named for section 1031 of the Internal Revenue Code, this type of transaction allows for the consecutive buying and selling of like-kind investment properties while putting off the tax liability for the sale. To qualify for this favorable tax treatment, investors must adhere to some rigorous guidelines.

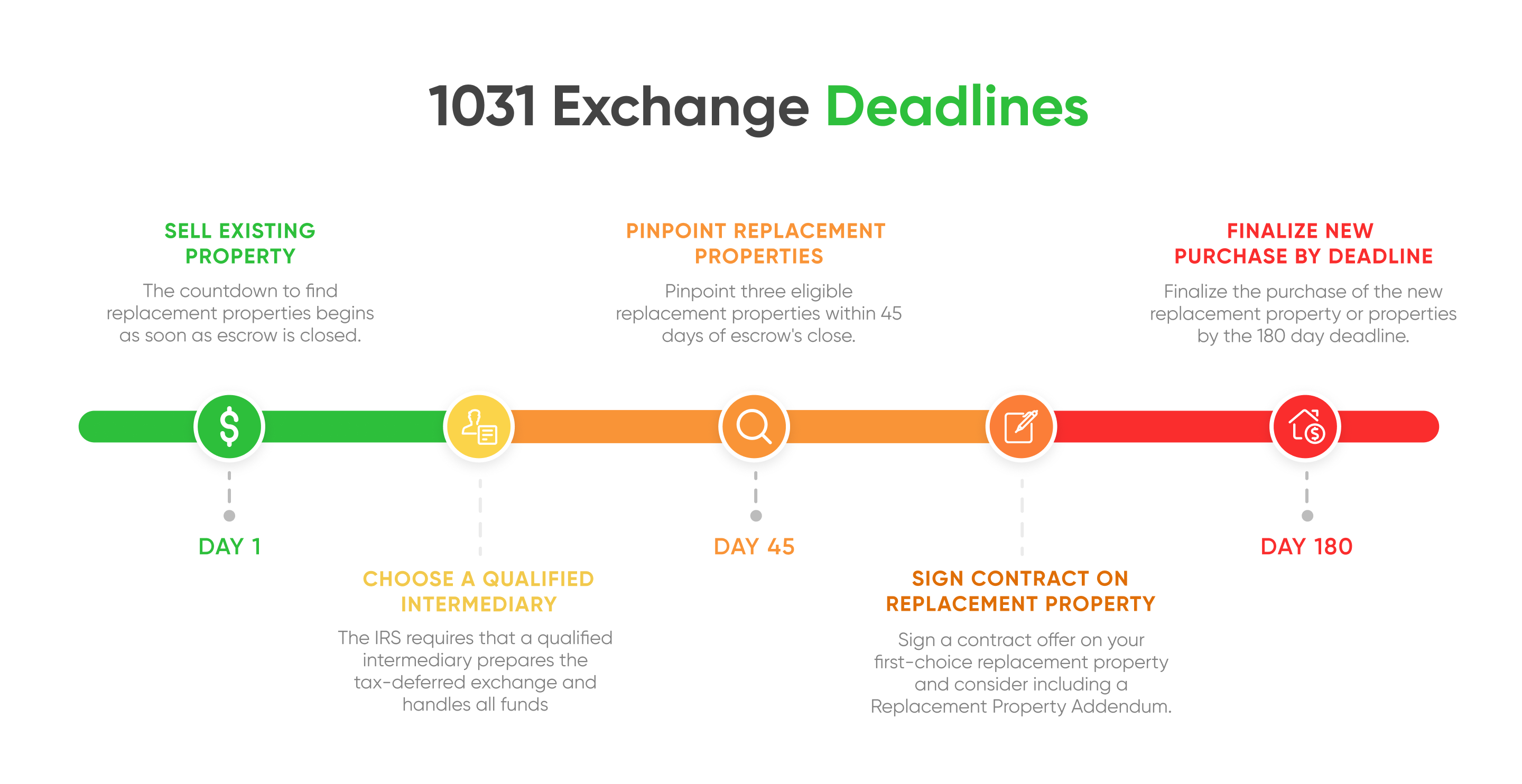

- The whole exchange, from beginning to end, must be consummated within 180 days.

- Before the first 45 days, after the close of escrow on the sold property, the investor must present the Internal Revenue Service (IRS) with three potential properties as like-kind candidates.

- A purchase property must be approved before moving forward, meanwhile, the clock does not stop ticking on the 180 days.

Given the inflexibility of these rules, many investors opt for hard money bridge loans to buy the like-kind property. Oftentimes this is done as a safety net so that the 180-day termination date does not restrict the buyer. Since hard money loans can close in a fraction of the time it takes for traditional mortgages, investors can protect themselves weeks or months before the deal would be otherwise canceled. In fact, California Hard Money Direct has funded loans in as little as a week, giving their clients time to spare, and stress to avoid.

1031 EXCHANGE FINANCING in California

California Hard Money Direct can help you close on your replacement property in time. Many investors turn to a bridge loan. Contact us today to learn more about our assistance in 1031 Exchange Financing.

Investment Entities Eligible for a California 1031 Exchange

You can legally avail your self of a 1031 Exchange if you are any one of the following. Sole proprietors, S-corporations, C-corporations, limited partnerships, general partnerships, limited liability companies, trusts and any other business entity that pays taxes to the IRS.

What Makes a Property Acceptable as Like-Kind?

The property selected as the replacement cannot be the borrower/investor’s primary residence nor a vacation home. It must be for business and income purposes only. In addition, the property must be similar to the property recently sold. Similar for example in units, square footage, exterior dimensions and income potential.

As noted, the applicant has 45 days after closing on the sale to locate three eligible replacements for the IRS to evaluate. Depending on the market, this is either ample time or not nearly enough. Remember, the entire process must be completed before 180 days. Again, the availability of real estate inventory dictates whether this puts more or less pressure on the investor. Most people experienced in commercial real estate understand the many variables that can delay getting a transaction closed. Six months looks generous until issues arise regarding title claims, certificates of occupancy, leases, etc.

Read what other borrowers have to say

Laurence Stewart

There are times when a “hard money loan” makes sense. When it does, the last thing you want to do is chase your tail with an unscrupulous vendor that will charge too much and may not be able to close the loan. I needed to pull equity out of a condo for a couple of rehab projects I have going and I’m very happy with my results from California Hard Money Direct. I would absolutely use them again.

Thomas Zacharia

Thank you Judy for acquiring funding for our Purchase of a luxury condo. Judy was able to get me a $1.785 million loan, 65% LTV, with very little docs as it was an SFR investment property. This was a celebrity client with many demands. I would highly recommend Judy to anyone needing a loan fast and with the utmost professionalism.

Liz Carnes

After spending 8 months in an effort to get reasonably priced financing I lucked upon Judy at California Hard Money Direct. Judy connected me with the right people at the perfect time, all at what I would consider “bargain” hard money pricing for both the origination fees and the loan interest rate. Judy is responsive, straight and direct in her approach, easy to reach, and overall a pleasure to deal with. Judy, thanks for making it happen!

Hard Money When Deadlines Draw Near

Commercial and investment properties are often subject to different rules in terms of financing. The collateral becomes all the more important because it represents the income of the borrower. It goes without saying, then, that the bank or finance company will require documented evidence that the property has a history of, and capacity to, generate sufficient revenue to mitigate the risk of the loan. This can be tedious and extend the process. Keep in mind, banks don’t care the borrower may have a 180-day deadline. Banks are just thinking about protecting their interest most of the time.

Enter hard money or private money. It is called such because it consists of private funds provided entirely on the basis of the property value and its promise to perform. It serves as a bridge loan when it is issued in anticipation of subsequent financing by a more traditional lender. California Hard Money Direct supports investors with this type of transitional financing. Once the expected mortgage loan is made, the hard money lender recoups the bridge loan from the new loan’s proceeds. This process relieves the investor of anxiety while preserving the tax benefits of the 1031 Exchange.